south dakota sales tax rate lookup

Sales Tax Rate Lookup. 4 lower than the maximum sales tax.

Sales Taxes In The United States Wikiwand

Tax collections from the 2022 South Dakota State Fair are at 24302683 according to figures released by the South Dakota.

. South Dakota has recent rate changes Thu Jul. The South Dakota SD state sales tax rate is currently 45. Municipal governments in South Dakota are also allowed to collect a local-option sales tax that.

The average cumulative sales tax rate in the state of South Dakota is 523. Just enter the five-digit zip. With local taxes the total sales tax rate is between 4500 and 7500.

General Municipal Sales Tax. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933. The South Dakota SD state sales tax rate is currently 45 ranking 36th-highest in the US.

Other local-level tax rates in the state of South. Average Sales Tax With Local. Depending on local municipalities the total tax rate can be as high as 65.

General Information on State Sales Tax. Depending on local municipalities the total tax rate can be as high as 65. The base state sales tax rate in South Dakota is 45.

This takes into account the rates on the state level county level city level and special level. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum. 2022 List of South Dakota Local Sales Tax Rates. All businesses licensed in South Dakota are also required to collect and remit municipal sales or use tax and the municipal gross receipts tax.

Strong Tax Collection Figures at 2022 South Dakota State Fair. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. 31 rows The state sales tax rate in South Dakota is 4500.

The South Dakota sales tax and use tax rates are 45. Following the 2018 South Dakota vWayfair US. If you need access to a database of all South Dakota local sales tax rates visit the sales tax data page.

Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. Counties and cities can charge an additional local sales tax of up to 2 for a maximum. Find your South Dakota.

A tool to look up state and municipal sales or use tax rates for any location within South Dakota. Visit the Online Services at httpsdorsdgovonline-services. There are a total of 290 local tax jurisdictions across the state.

Just enter the five-digit zip. South Dakota law also requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one. South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

Fillable Online State Sd Sales Tax Return State Of South Dakota State Sd Fax Email Print Pdffiller

Jonesboro Sales Tax Rates Jonesboro Use Tax Rates

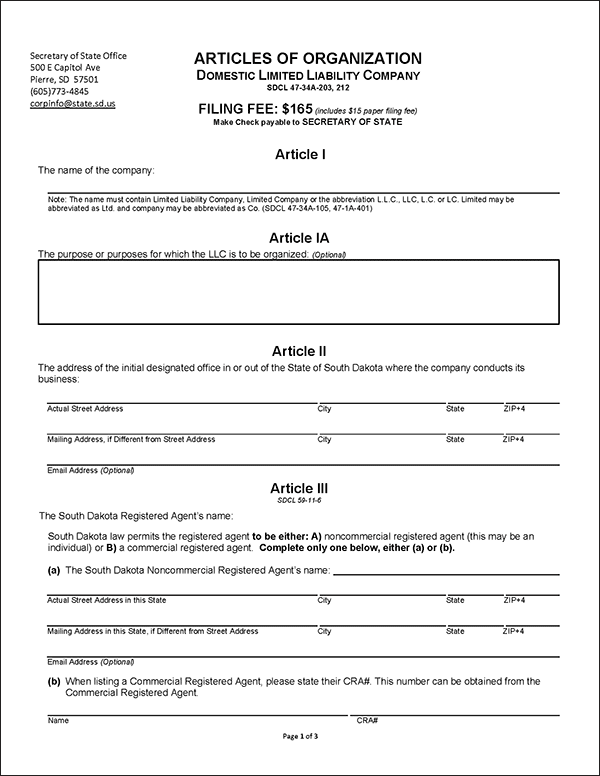

South Dakota Llc How To Start An Llc In Sd Truic

Welcome To The North Dakota Office Of State Tax Commissioner

Sales Taxes In The United States Wikipedia

29734 Sales Tax Rate Sc Sales Taxes By Zip September 2022

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

85283 Sales Tax Rate Az Sales Taxes By Zip September 2022

Fall River County South Dakota 906 N River Street Hot Springs Sd 57747

Wyoming Sales Tax Rate Rates Calculator Avalara

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

South Dakota V Wayfair And Streamlined Sales Tax Check Sales Tax

State Sales Tax Rates Sales Tax Institute

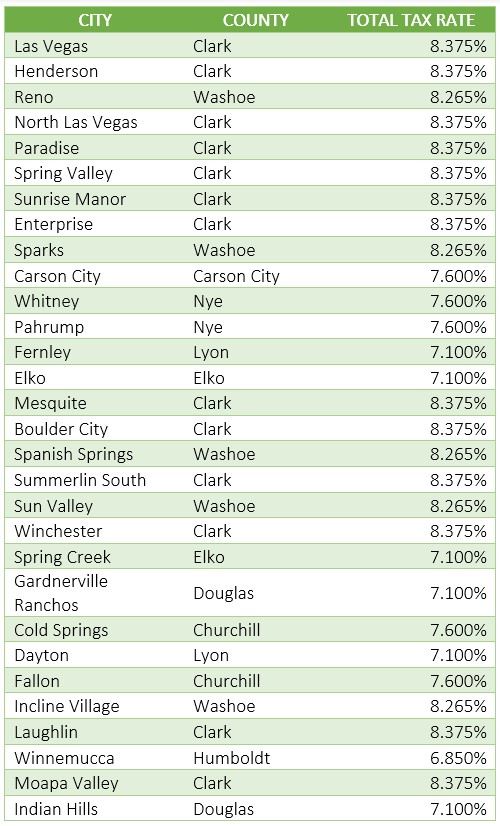

Nevada Sales Tax Guide For Businesses

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Taxes In The United States Wikipedia